- Eligibility

- Basic Technical Analysis

- Language

- English, Hindi, Bengali

- Learning Mode

- Online Classroom

- Duration

- 3 Months

- Faculty

- Mr. Susanta Malik

5 (85 Rating) 205 Students Enrolled

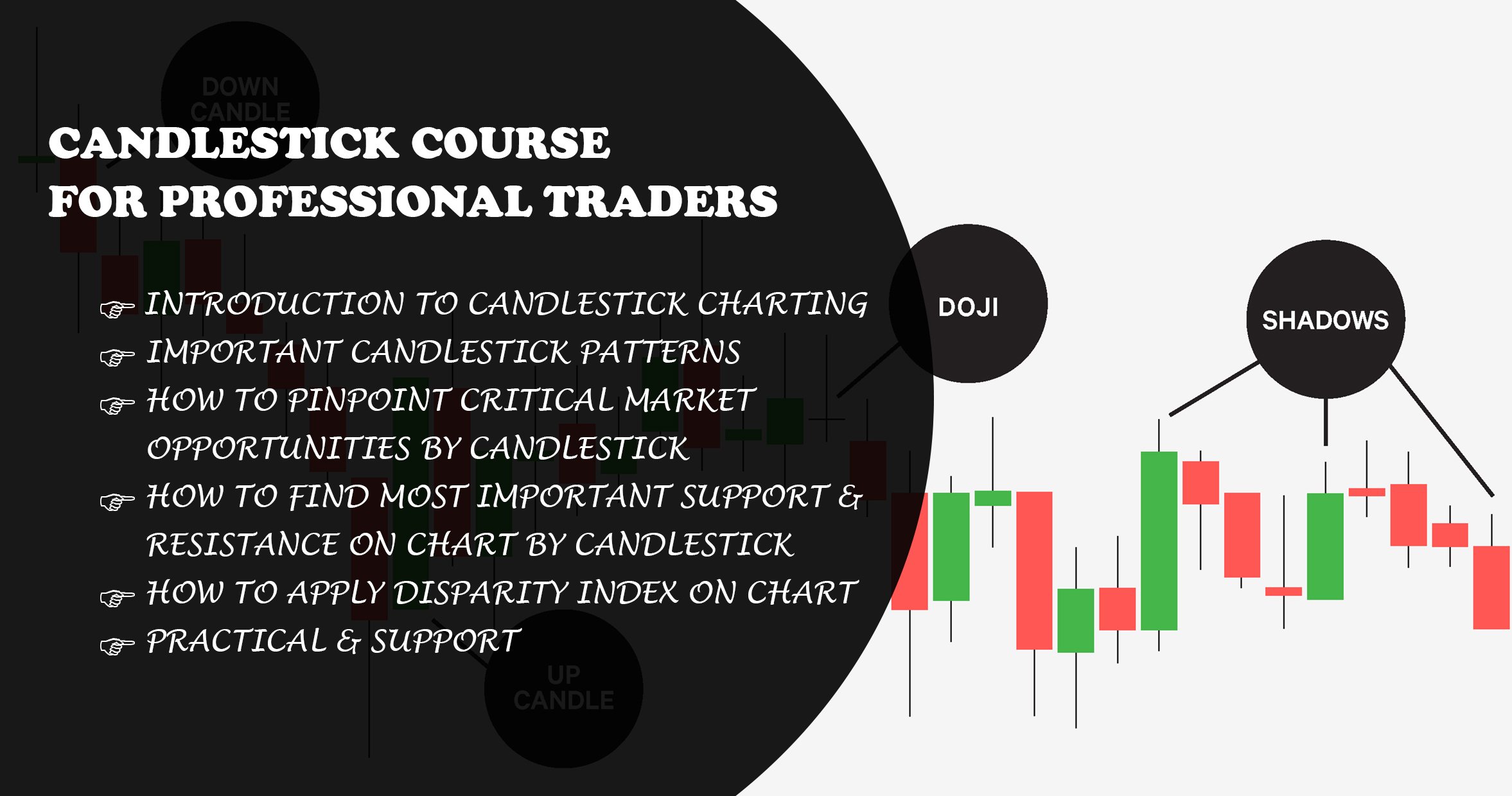

A candlestick chart (also called Japanese candlestick chart) is a style of financial chart used to describe price movements of a security, derivative, or currency.

What is the advantage of the candlestick?

Over time, the candlesticks group into recognizable patterns that investors or traders can use to make buying and selling decisions . It isa language of price behaviour. It will describe by three points.

Intended Participants

What is the advantage of candlestick charting method than Other charting methods?

I think the candlestick method is the language of the stock market. Candle make trader a doctor of the market. So you read & react to the symptoms of the market’s health through candles techniques may not be the same as another candle practitioner. You trade with candles will depend on your trading philosophy, your risk adversity & your temperament.